Stock markets world over are driven by sentiments. It is said greed and fear drive stock markets more than money. We all suffer from these emotions while making our investment decisions.

When it comes to many areas of our life we can rely on our emotions and instincts or gut feelings. But when it comes to investing in the stock market this is a big mistake.

How can we overcome these emotional factors and make a sound investment decision? Some psychologists believe that emotions can play a positive role while investing. However not many people are able to use their instincts to make successful trades. So if the professional investors can’t do it then you shouldn’t fool yourself into thinking you can, especially if you are a novice investor. You need to stick to the basics and invest by the book, following a proven strategy that has its foundation backed by fundamentals and solid research.

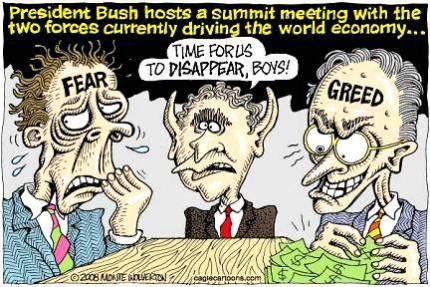

Fear and Greed

Most investors are driven by two main emotions, namely fear and greed. And, as has been proven time and again, using fear and greed to guide your investment decisions will usually lead you to lose money.

Most investors are driven by two main emotions, namely fear and greed. And, as has been proven time and again, using fear and greed to guide your investment decisions will usually lead you to lose money.

When you see a negative news story about a stock in your portfolio and you fear for your money, you may rush to call your broker and scream “SELL, SELL, SELL!” Without a second thought. This is a serious error. You are not making a rational decision by doing this. Emotions have no place in trading.

How many of us had invested in Reliance Power IPO with hopes that it will list with at least 100% premium? Or have sold and didn’t bought back Satyam few months back when it tumbled to Rs. 6 and then again rose to around Rs. 35? During Reliance power greed was driving us, while during Satyam fear had the best of us. These reactions are natural. The truth is “bubbles burst” and “grey clouds” pass over, but we end up loosing money whenever fear or greed is involved.

Love

Another big emotion that can prevent you from making good investment decisions is love; falling in love with the company you have an investment in. When the stock is falling due to the fundamentals and the business is no longer viable and it comes time to dump it, you need to be able to do it without blinking. If you can’t separate your love from the company then it will cost you big. Try to never get attached to any of your investments. Most of us invest for reason and one reason alone, that is to make money.

You are not investing because you love the stock or because you enjoy the rush. You are doing it only to make money. Never get emotionally attached to anything you invest in. Because if you do and can’t separate yourself from the stock then you’ll never make any money because the only way you’ll make any real money is when you actually “sell” the stock.

Emotional Inteligence – Daniel Goleman !