Personal financial planning is a process of managing money to achieve personal economic satisfaction. It is often confused with Investment planning, however financial planning is not just about investment but covers much larger gamut of managing your money.

The most important tool of personal financial planning is the financial plan. In general usage, a personal financial plan can be a budget, a plan for spending and saving future income. This plan allocates future income to various types of expenses, such as rent or utilities, and also reserves some income for short-term and long-term savings. A financial plan can also be an investment plan, which allocates savings to various assets or projects expected to produce future income, such as a new source of income, business or product line, shares in an existing business, or real estate.

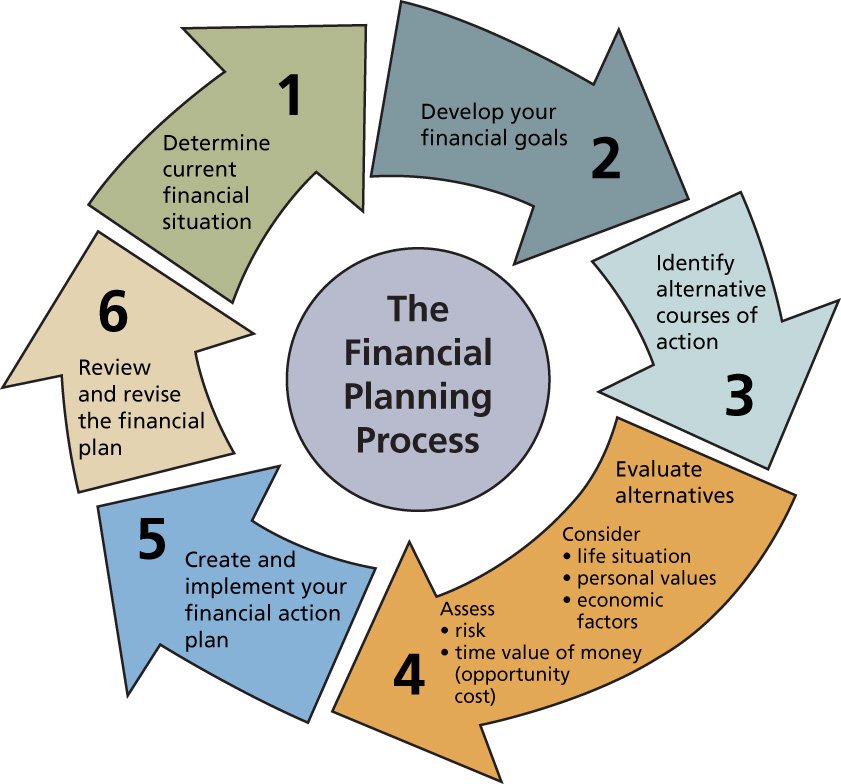

Personal financial planning process involves following steps :

Step 1: Determine your current financial situation.

your personal financial situation can be assessed by compiling simplified versions of financial balance sheets and income statements. A personal balance sheet lists the values of personal assets (e.g., car, house, clothes, stocks, bank account), along with personal liabilities (e.g., credit card debt, bank loan, mortgage). A personal income statement lists personal income and expenses.

Step 2: Develop your financial goals.

Two examples are “retire at age 55 with a personal net worth of Rs.2,000,000” and “buy a house in 3 years paying a monthly housing loan installment (mortgage servicing cost) that is no more than 35% of my gross income”. It is not uncommon to have several goals, some short term and some long term. Setting financial goals helps direct financial planning.

Step 3: Identify alternative courses of action.

Once your short term and long term goals are set, evaluate th gap between your current as well as desired situations. The financial plan details how to accomplish your goals.

Step 4: Evaluate your alternatives.

It could include, for example, reducing unnecessary expenses, increasing one’s employment income, or investing in the stock market, mutual funds or regular savings plans.

Step 5: Create and implement your financial action plan.

Execution of your personal financial plan often requires discipline and perseverance. Many people obtain assistance from professionals such as accountants, financial planners, investment advisers, and lawyers.

Step 6: Review and revise your plan.

As time passes, your personal financial plan must be monitored for possible adjustments or reassessments. This is a cyclical processes.

Advantages of personal financial planning:

1) Increased effectiveness in obtaining, using, and protecting your financial resources.

2) Increased control of your financial affairs.

3) Improved personal relationships.

4) A sense of freedom from financial worries obtained by looking to the future.

Thanks for sharing such great post, according to me Our financial life planning is also the same as football, there are so many similarities like never give up, have patience, try another goal, etc.

Well actually the credit goes to Mr. Kartik Varma, Co-founder of iTrust Financial Advisors, it was his original concept.

Wonderful submit from skilled also it would most likely be an exquisite know-how one can us and thank you a large number for posting this beneficial info with us all.